Borrow 50000 mortgage

If you had a 10 mortgage deposit and were purchasing. Youll borrow less with a small mortgage loan.

How To Get A 50 000 Personal Loan Bankrate

Say you owe 150000 on your primary mortgage and 50000 on your second mortgage.

. Our mortgage calculator helps by showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal. Minimum 50000 in non-Citadel mortgage balances. 59 payments of 10019 with a final payment of10022.

Buyers in towns with low home prices dont need to borrow hundreds of thousands of dollars to buy a home. For example if you buy a 90000 home and qualify for a conventional mortgage 3 down would be 2700. And that equation isnt just based on your salary.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. You can pay off your mortgage faster. Borrow from the bank at a real interest rate of.

A mortgage is one of the biggest commitments youll make in your financial life. 3 25bp discount for loans set up with monthly automatic payments from RCB deposit account excludes HELOC products. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price.

In Binghamton NY for example the median listing price is about 139000 according to. Borrow from her 401k at an interest rate of 4. Your insurance provider covers 125 of your mortgage.

Someone on a single income of 90000 can borrow 85000 less for a home loan than they could a year ago and a couple with a 200000 combined salary can borrow a quarter of a million dollars less. Qualified members can finance 80 loan to value less outstanding mortgage. First-time buyers can borrow nearly 50000 more after the Bank of England relaxed its mortgage lending rules.

Qualified members can finance 90 loan to value less outstanding mortgage. That means your monthly mortgage payments will also be lower. The amount you can borrow through a HELOC is again based on your homes equity.

A first position loan is available only if there is no outstanding mortgage balance or other first-lien obligation. This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only. We know that when it comes to securing a loan for your dream home one size does not fit all.

But a HELOC acts more like a credit card with a maximum credit limit based on this equity amount. The actual cost of a 50000 personal loan depends on factors such as your interest rate repayment terms and fees. Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate.

Mortgage Payment Protection Insurance MPPI MPPI provides longer mortgage protection for 12 months up to 2 years depending on your policy. But with so many possible deals out there it can be hard to work out which would cost you the least. If youre a first time homebuyer or want to refinance your house review our mortgage rates and apply for a mortgage online today.

Get an idea of how much you could borrow and how much your monthly repayments might be with our mortgage calculators. Monmouthshire Building Society pledge 50000 to local community. Dual Index Mortgage.

The minimum amount you would have to contribute is a 5 mortgage deposit so a 95 loan-to-value mortgage although this minimum may differ depending on what type of mortgage you are looking for. How much can you borrow. Learn why small mortgage loans are so hard to find.

Available to sole applicants with a minimum salary of 50000 or joint applicants with combined salaries of 75000 or where one party has an individual salary of 50000. Borrow up to 50000 for a used car for 8 years with no monthly. Find a mortgage for you.

The loan exceeds a specific size such as 50000 Pros and cons of taking out a life insurance loan. As a requirement you must make a 5. Mortgage industry rules.

It was a wake-up call nearly 50000 in the making. How much will a 50000 loan cost with interest. Between three credit cards a line of credit personal loans from friends account overdraft and a car loan Eduek Brooks had found herself with.

A chattel mortgage calculator comes up with a repayment amount based on the information you provide using basic arithmetic. Youd need to refinance the two loans into one loan of 200000 or more if you. Not available for.

These factors vary by lender. By contrast 3 down on a 200000 home is 6000. Calculators are provided to help you determine how a loan line of credit or deposit account may affect your budgetThe results offered are estimates and do not guarantee available loan terms cost savings or tax benefits.

Citadel home loans offer low mortgage rates and flexible terms. Heres how to work with mortgage lenders to get a minimum mortgage amount below 50000. This would be equivalent to being able to borrow an extra 28000 on a mortgage.

Your monthly payments are lower. Borrow from your homes equity to finance a home renovation or purchase. No PMI Adjustable-Rate Mortgage ARM Loan amounts from 50000 - 1500000 Payment examples do not include the cost of property tax or insurance so the actual obligation will be greater.

Axos Bank does not guarantee your results as determined using this calculator. 2 Used vehicles - maximum of 80 of Purchase Price or NADA blue book value whichever is less autos with model years not older than 5 years - currently 2016. In addition you dont have to pay the annual interest so long as the total outstanding loan original loan plus accumulated interest doesnt exceed the.

Whether youre looking to purchase a new home or refinance a current property Wescom offers fixed and adjustable rate mortgages for loan sizes ranging from 50000 to. Theres a whole host of factors lenders. Loans up to 50000 max term 6 years for new cars 2021 model year.

As part of calculating your mortgage we will ask how much money you have to put towards the deposit for your mortgage. The amount you can borrow for a mortgage depends on how much a lender thinks you can pay back. Whether youre looking to buy your first home move somewhere bigger or simply get a better deal we can offer a mortgage that suits you.

When you borrow from your life insurance policy you dont have to pay back the loan. A type of mortgage where the interest rate paid on the outstanding balance is indexed to a interest rate benchmark plus a margin and the actual total mortgage payments are. The value of the property determined by an appraisal compared to the amount you wish to borrow represents your loan-to-value or LTV Typically.

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

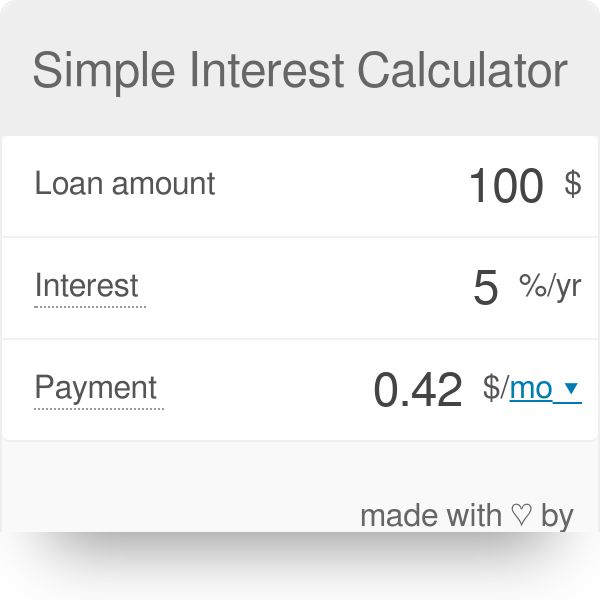

Simple Interest Calculator Defintion Formula

50k Loans 50 000 Loans For Good Or Bad Credit Acorn Finance

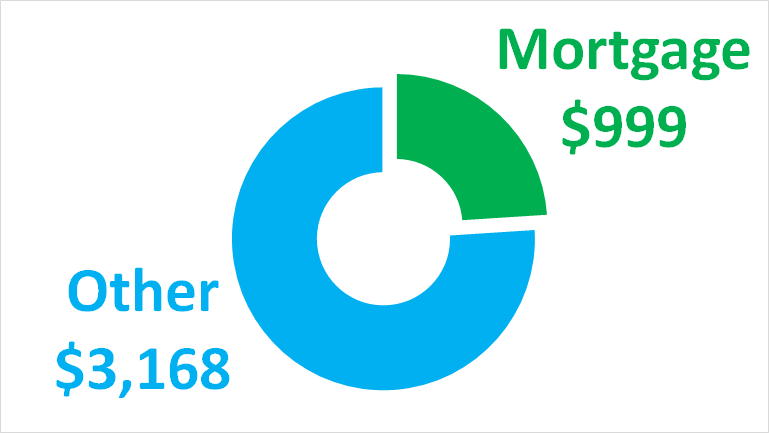

Options Pay Off Mortgage Or Invest

4 Personal Loan Lenders That Ll Give You As Much As 50 000

50 000 Loan Calculator Best Rates For Good Or Bad Credit Finder Uk

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

Personal Loan Calculator Student Loan Hero

Family Loan Agreements Lending Money To Family Friends

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

First Time Buyers Can Borrow 50k More As Mortgage Rules Relaxed

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Personal Loan War Heats Up As First Direct Raises Limit To 50 000 Borrowing Debt The Guardian

![]()

How Much House Can I Afford Interest Com

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Get A Small Dollar Mortgage Forbes Advisor

I Make 50 000 A Year How Much House Can I Afford Bundle